Argentina is currently facing a crucial moment as Milei’s proposal to adopt the US dollar as the official currency encounters major obstacles. This situation underscores the complex relationship between economic policies, geopolitical factors, and the stability of the country’s finances. Given the daily inflation of the Argentine Peso, which is causing an increase in poverty rates and destabilizing the economy, Milei’s suggestion to officially adopt the US Dollar as the national currency is seen as a temporary solution to restore financial stability and address the issue of hyperinflation. Nevertheless, the process of adopting the US dollar as the official currency is filled with difficulties, and detaching from China, a significant participant in Argentina’s economic environment, presents a formidable barrier.

Milei’s dollarization concept is based on the idea of introducing US Dollars into the economy to alleviate the effects of hyperinflation and normalize everyday transactions. Since taking office, inflation in Argentina has surged, with monthly rates reaching double digits and yearly inflation approaching 300%, far surpassing wage growth and undermining the ability to buy goods and services. Milei’s advocacy for dollarization is driven by the pressing need to solve this problem and is seen as an essential measure to restore economic stability and promote prosperity.

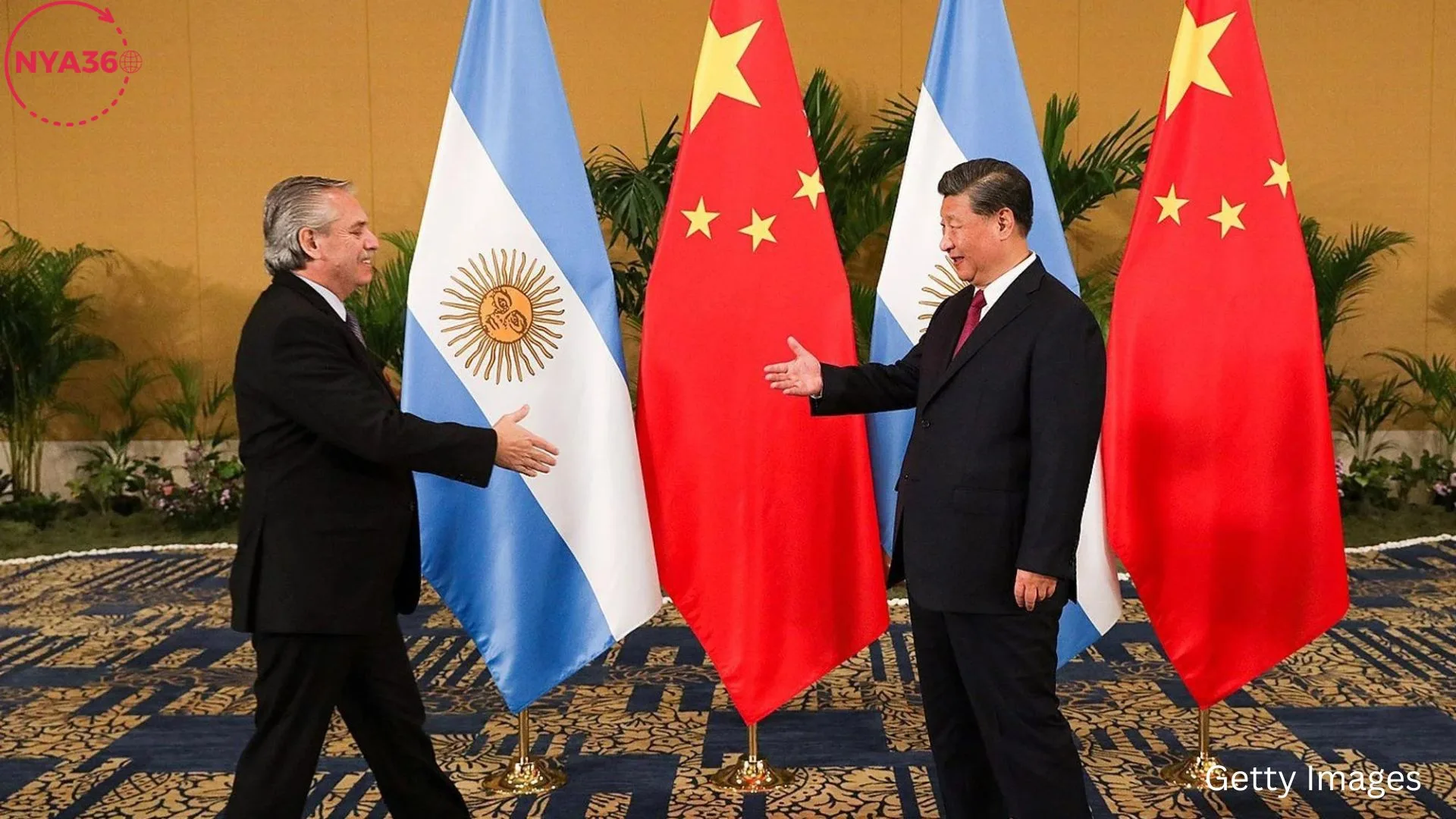

Nevertheless, Milei’s proposal has substantial obstacles, as the schedule for implementing dollarization has been postponed until late 2025 due to practical setbacks and political factors. Although he strongly opposes China and promises to cut off connections with Beijing, the actual situation highlights the crucial role of China in Argentina’s economic environment. The strong trade ties between China and Argentina, which involve substantial imports and investments, provide a dilemma for Milei. He is now in a paradoxical situation where he requires China’s help to accomplish his objectives of dollarization.

The foundation of Argentina’s economic relationship with China is the Yuan currency swap line, which allows Argentina to get the necessary Yuan currency to support imports from China. Although Milei expresses strong criticism against China, the practical need to sustain this crucial economic connection becomes evident as Argentina faces a trade deficit and encounters difficulties in accumulating US Dollars. The Yuan swap line serves as a vital means of liquidity, enabling Argentina to counterbalance the departure of Dollars and stabilize its economy shortly.

Additionally, Argentina’s debt issue highlights the significance of preserving positive relations with China. Argentina, burdened by an enormous debt and facing restricted access to global markets, depends on Chinese investments and financial assistance to manage its unstable economic condition. If Argentina were to experience any disruption in its relations with China, it might worsen the country’s debt problems, leading to an increase in bond yields and further disrupting the economy.

Although Milei’s plan for dollarization is based on decreasing dependence on China and strengthening relations with the United States, the practical circumstances require a more subtle and intricate strategy. The substantial influence of China in Argentina’s economy, encompassing trade links and investments in crucial infrastructure projects, highlights the complex network of economic interdependence that goes beyond political rhetoric.

Argentina is currently facing a critical situation where it must carefully manage the need for economic stability, geopolitical factors, and domestic political dynamics. Milei’s audacious proposal to adopt the dollar as the official currency of the economy signifies a daring deviation from traditional monetary strategies, but its effectiveness relies on skillfully maneuvering through the intricate geopolitical environment and finding common ground among conflicting interests.

In the end, the future of Argentina’s economy depends on its capacity to establish practical alliances with influential actors such as China, while also pursuing enduring methods for sustained economic expansion and progress. Milei’s pursuit of dollarizing the economy emphasizes the inherent conflicts between ideological beliefs and practical realities, emphasizing the intricate equilibrium needed to negotiate the intricacies of modern geopolitics and global economics. Argentina faces numerous hurdles as it considers adopting the dollar as its currency. However, by employing strategic planning and diplomatic flexibility, the country has the potential to achieve economic revitalization and prosperity.

Follow us on social media: Instagram, Threads & Twitter X @nya360_ YouTube & Facebook @nya360.