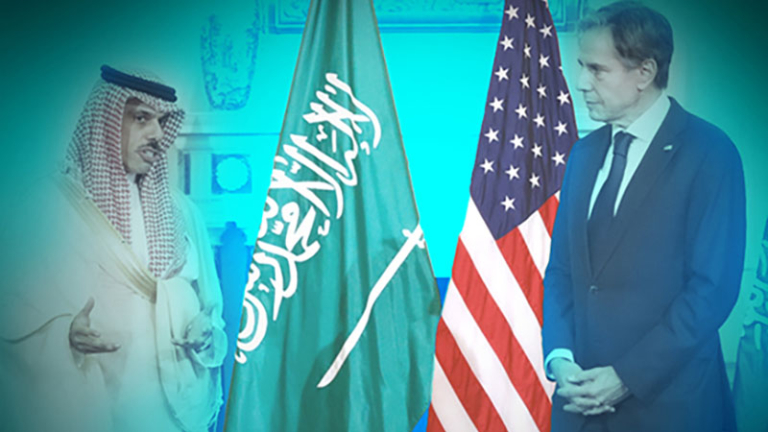

Iran has issued a dire warning as the partnership between the United States and Saudi Arabia seems to be eroding.

This is a succinct overview:

US-Saudi Relations Strained: There are indications that the once-strong partnership between the US and Saudi Arabia is becoming strained. With Saudi Arabia postponing the normalization agreement with Israel, the United States seems to be losing ground in the Middle East.

Iran’s Warning: Iran has sent out a warning, suggesting that any Israeli ground action might cause tensions in the region to flare up. There are worries of more instability in the Middle East as a result of this warning.

These changes are a reflection of the Middle East’s changing dynamics and might have a big impact on both regional stability and world politics. The stability and economy of the world are being negatively impacted by the increasingly unstable conditions in the Middle East. The following are some salient features of the data supplied:

Saudi Arabia and the Israel Deal: Saudi Arabia is interacting with Iran while postponing the normalization agreement with Israel. This is a noteworthy development that illustrates how the Middle East’s dynamics are changing. In order to increase its power in the area, the United States was counting on this agreement.

Losses for the US in the Middle East: The US has suffered a number of setbacks in the Middle East, including the collapse of the Iran-Saudi peace agreement, China’s increasing influence in the area, and its withdrawal from Afghanistan. The BRICS (Brazil, Russia, India, China, and South Africa) economic bloc has also grown. The US’s influence in the Middle East is being undermined by these events.

Economic Repercussions: There are extensive economic repercussions from the Middle East conflict. The US is sending Israel military aid in a hurry, which may result in increased military spending. This might intensify inflationary pressures together with any disruptions in the oil markets’ supply.

Oil Markets in Chaos: OPEC countries account for the majority of the world’s oil production, and the Middle East is one of the world’s main oil suppliers. Any interruption to supply in this area would have a disastrous effect on the world economy.

Supply Side Inflation: Because interruptions in the oil and gas markets might lead to supply-side inflation, the Middle East scenario poses a potential to further increase inflation. Elevated oil costs have the potential to worsen the worldwide inflation issue.

Possible Blockade of the Strait of Hormuz: The Strait of Hormuz is a vital oil transit choke point. If it were blocked, it would have a disastrous effect on the world’s oil supplies and would even spark economic unrest across the board.

Suez Canal Vulnerability: The fighting may also have an effect on the Suez Canal, which is close to Egypt and Israel. Any disruptions here could result in higher shipping costs and delays in the shipment of goods, which would impact consumer goods and international trade.

Chinese Interests: China imports oil from Iran and has substantial interests in the Middle East. Any disturbance in the area may have an impact on China’s economic expansion and energy security, which would increase the effect on the world economy.

Request for Chinese Involvement: China is being asked by the US to exert influence over Iran and stop the situation from getting worse in the area, but China’s ability to do so is limited in this complicated scenario.

In conclusion, there is a chance that the Middle East’s growing tensions will affect the world’s oil supplies, raise prices, and have a major negative impact on the economy. As the battle develops, the situation is still extremely unstable and unexpected, and everyone is on edge.

Follow us on social media: Instagram, Threads & Twitter X @nya360_ YouTube & Facebook @nya360.